vermont income tax withholding

If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. You must pay estimated income tax if you are self employed or do not pay.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United.

. The income tax withholding for the State of Vermont includes the following changes. When finished click the Continue button. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

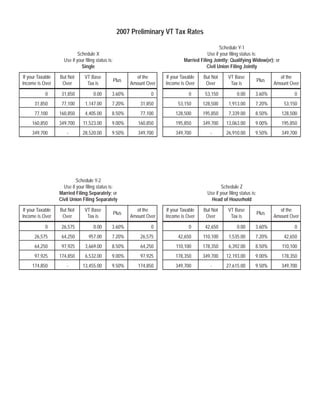

Filing online through the Vermont Department of Taxes new online system. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. New York City.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Withholding and Reporting for Escheated IRAs. Before 2018 it was unclear how federal income tax withholding and reporting for IRA assets that are paid to the states should.

All taxpayers may file returns and pay tax due for Withholding Tax using myVTax our free secure online filing site. Income Tax Booklet The. The annual amount per allowance has changed from 4400 to 4500.

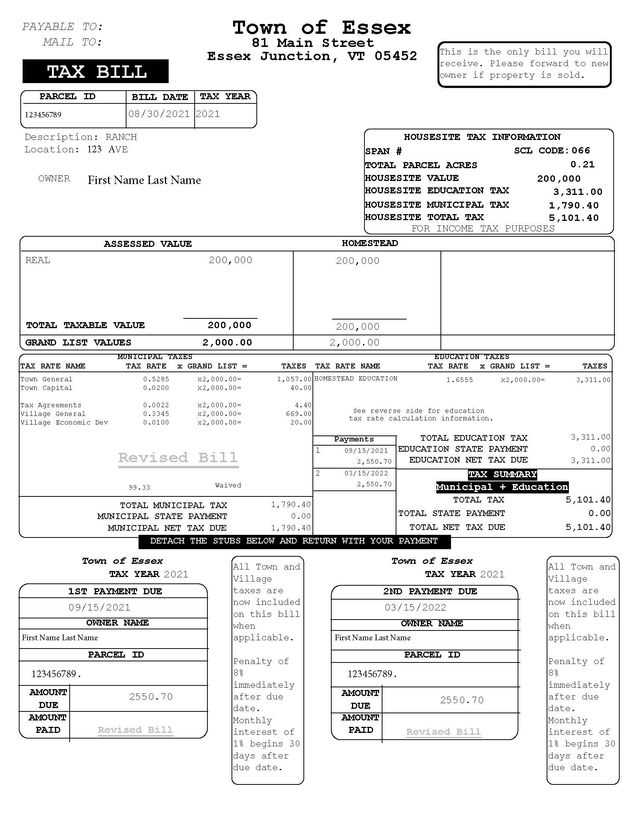

Vermont Tax Information Town Of Craftsbury

Personal Income Tax Department Of Taxes

State Withholding Form H R Block

Real Estate Taxes Burlington Vt Peet Law Group

In 151 Extension Of Time To File Vt Individual Income Tax Return

Personal Income Tax Department Of Taxes

Vermont Income Tax Vt State Tax Calculator Community Tax

Free Vermont Payroll Calculator 2022 Vt Tax Rates Onpay

Form In 111 Vermont Income Tax Return

2022 Federal State Payroll Tax Rates For Employers

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

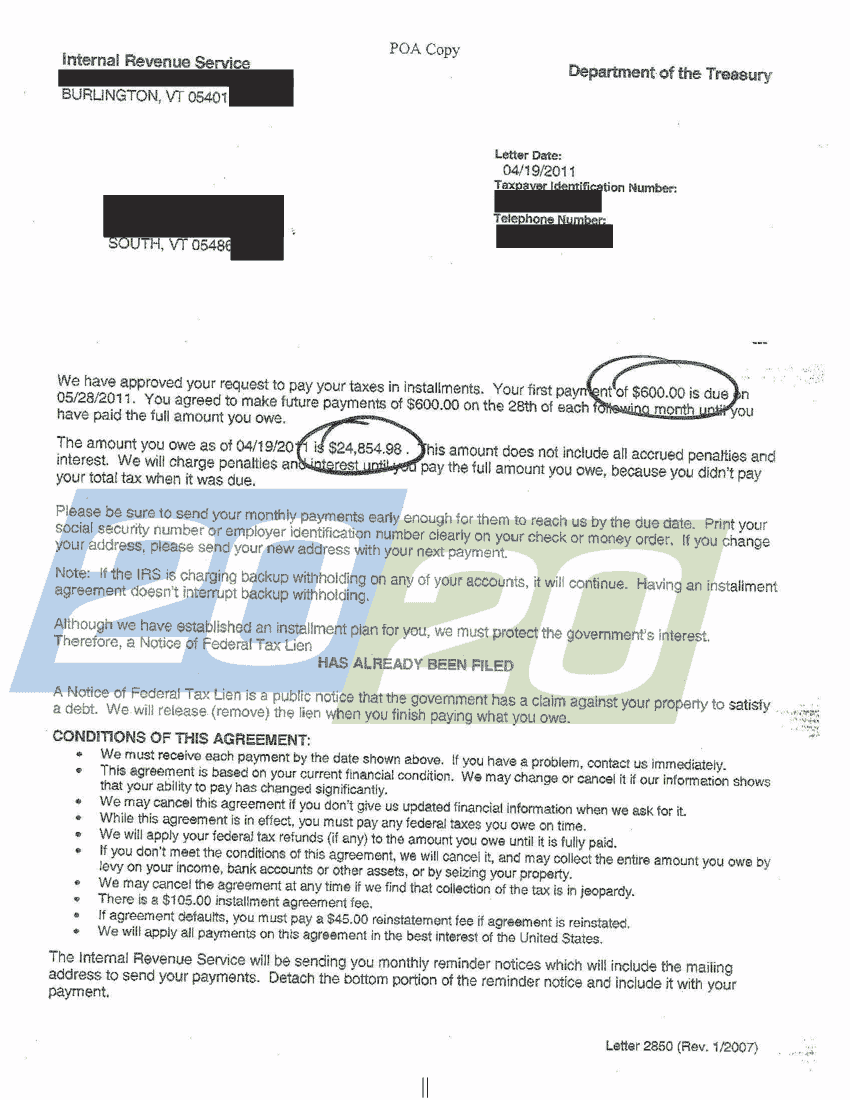

Successful Tax Resolutions In Vermont 20 20 Tax Resolution

Tax Year 2021 Personal Income Tax Forms Department Of Taxes